At the time of Shakespeare, the world mostly operated under an economic system known as mercantilism, in which more value was placed on gold (as money) than on commodities or merchandise. This belief caused mercantilists to further believe their wealth was their money, an idea Adam Smith would eventually refute in Wealth of Nations.

But that’s getting ahead of ourselves because Adam Smith was writing 150 years after Shakespeare.

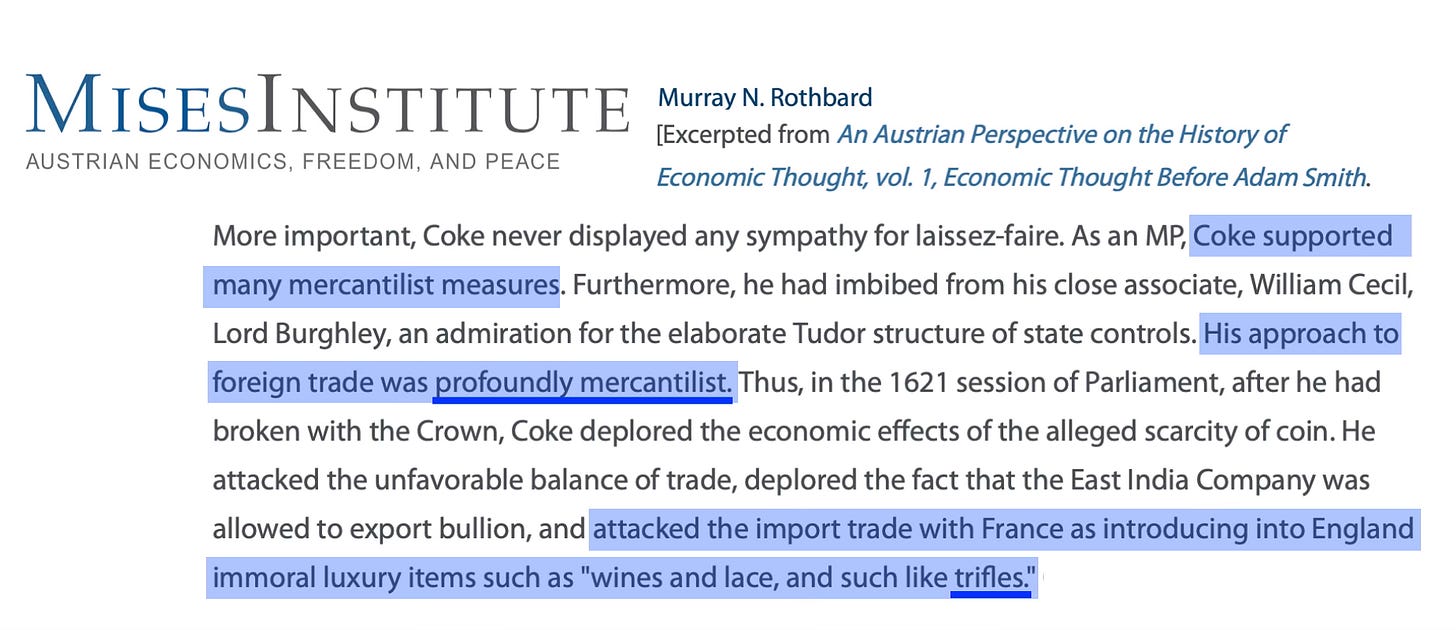

Because mercantilists believed gold was more valuable than merchandise, seen almost as worthless trifles, they were eager to export their merchandise to other countries for which they would be paid in gold. In fact, when articulating mercantilist policy, Sir Francis Bacon’s rival jurist, Edward Coke, is described below referring to such merchandise as “trifles.”

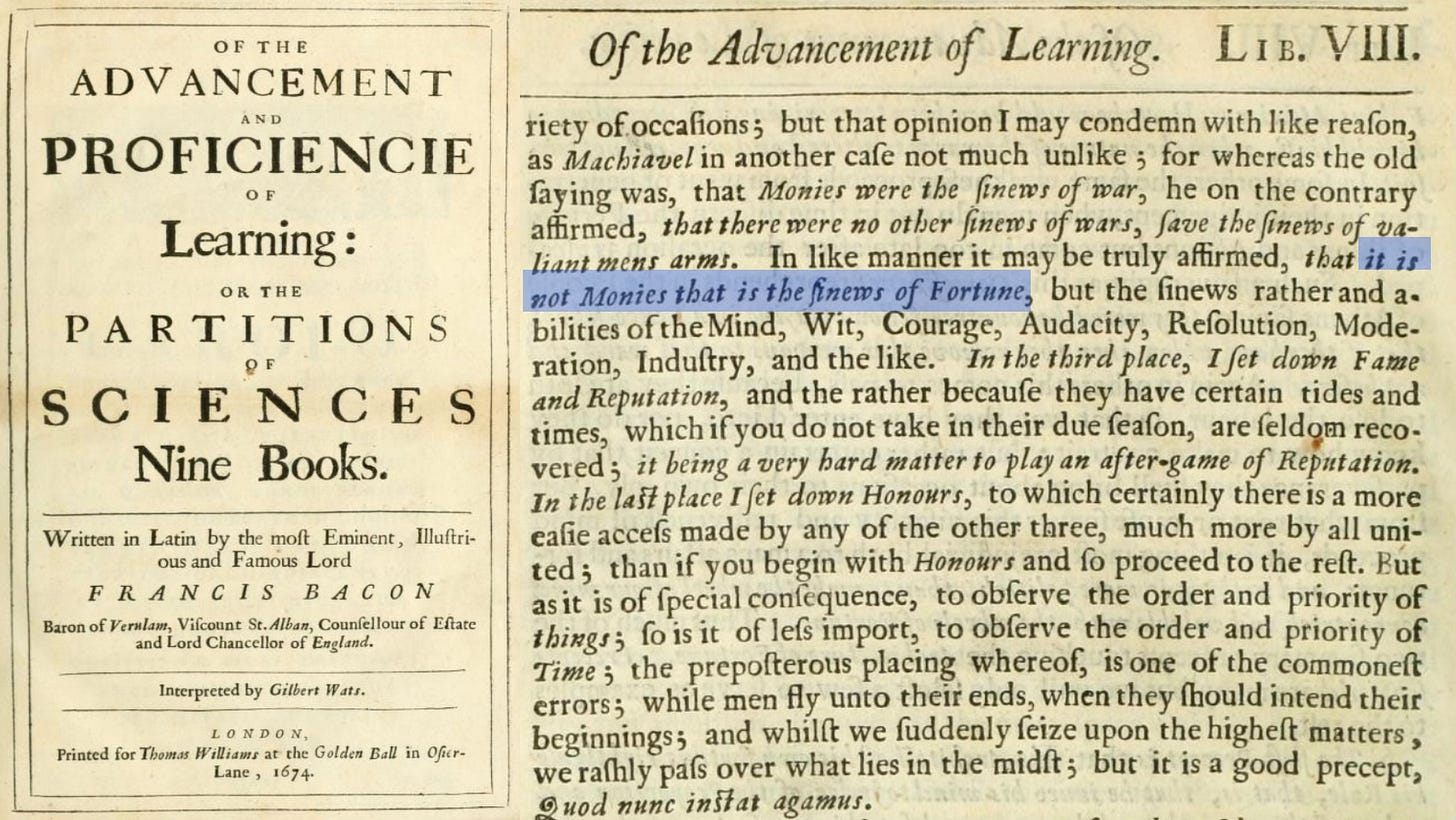

Francis Bacon, though, was often at odds with the mercantilist economics of his day. In Book 8 of Advancement of Learning, Bacon expressed an anti-mercantilist position when discussing the nature of money. He wrote that the sinews of fortune are not money, i.e., money is not wealth. He then elaborated, saying: “[I]t is not Monies that is the sinews of Fortune, but the sinews rather and abilities of the Mind, Wit, Courage, Audacity, Resolution, Moderation, Industry, and the like.”

A human mind, a human heart, and human action create merchandise, commodities, food (things of value to human survival and progress) and, as such, are a form of wealth. These aspects of the human being are known, in economic terms, as “human capital.” Capital in this form contributes to human survival in a way that money does not because money doesn't think and money contains no calories.

Bacon furthers this idea in “New Atlantis,” when the governor of the Strangers House says something revolutionary, in economic terms, to the voyagers: “As for any Merchandize you have brought, ye shall be well used, and have your Return, either in Merchandize, or in Gold and Silver; for to us it is all one.”

Somewhat similar to the function of the Templars Bank, which held gold for pilgrims traveling to Jerusalem, the Strangers House in New Atlantis is working sort of like a bank for traveling strangers, holding their merchandise for safekeeping. That merchandise would be well “used,” meaning the usury or interest paid to the travelers would be high, and the merchandise would be returned to them either in similar merchandise or in money.

This New Atlantean view of money was opposite that of mercantilism. The people of New Atlantis did not value gold money more than merchandise. They saw gold and goods as the same, “as one.” Two hundred years later, the French economist Jean-Baptiste Say would describe money in a similar way, as supply.

Here, Bacon is emphasizing the economic distinction that capital is an aspect of wealth, itself, while money is simply a measure of wealth and a measure of value. In “New Atlantis,” Bacon shows irrefutably that there is no greater value in money than in the merchandise it buys; in New Atlantis, money and merchandise are “all one.” Mercantilists, on the other hand, valued money higher than merchandise. They would rather export merchandise for money than pay money for imported merchandise. In New Atlantis, imports and exports would both be understood as valuable and necessary.

So how was money portrayed in the works of Shakespeare? A good place to look is in The Merchant of Venice, where a payment of money is equated by Shylock to a pound of human flesh.

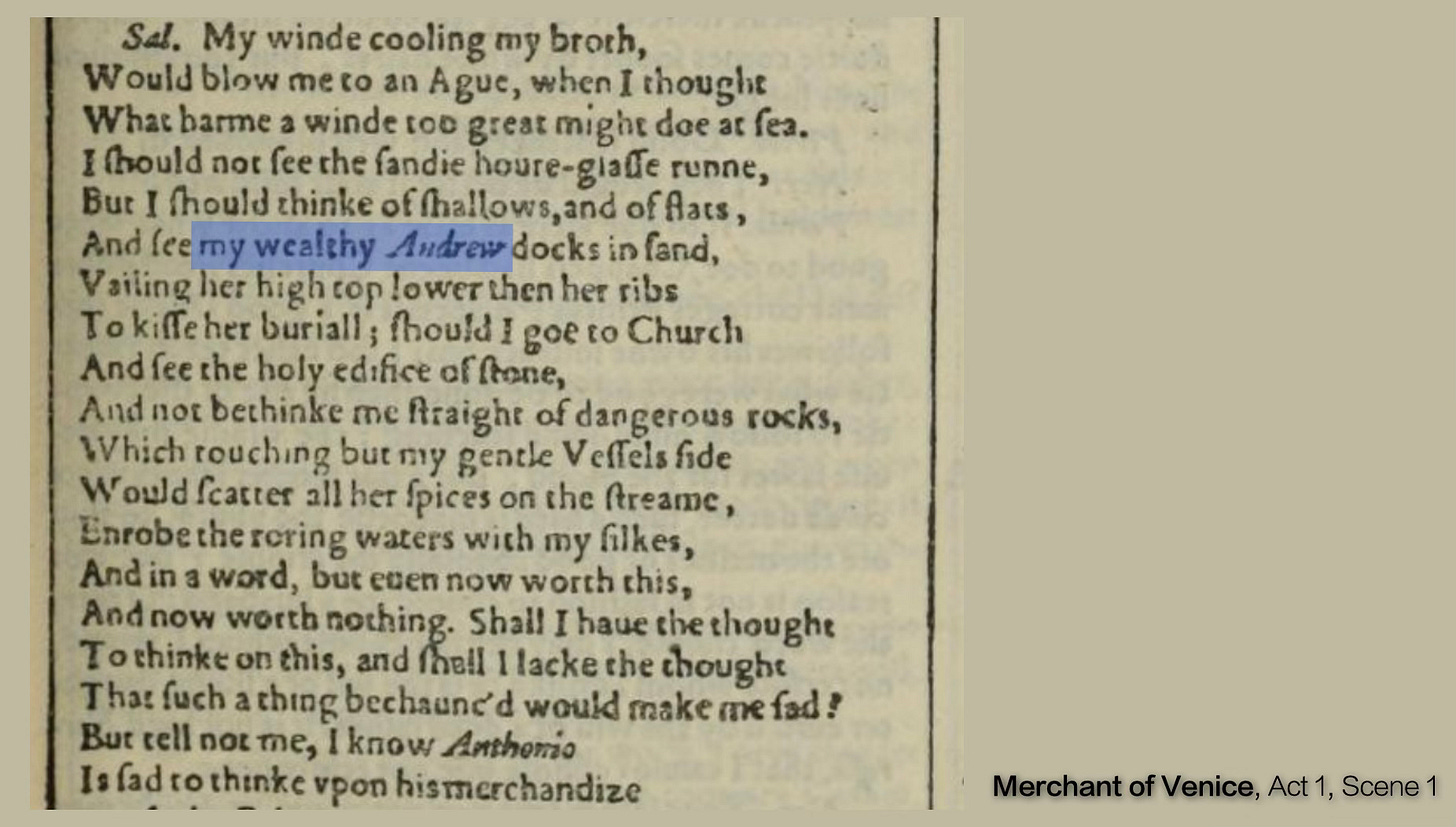

The author of The Merchant of Venice goes into much more detail regarding money at the beginning of the play. In Act One, Salanio believes that Antonio is sad (or worried) because his merchandise is on a ship that could be easily lost at sea. He’s painfully aware of the value of that merchandise and refers to the ship carrying his own merchandise as “my wealthy Andrew.”

At the end of his speech, Salanio says, “Antonio is sad to think upon his merchandise.” Unlike the mercantilists, Salanio recognizes that merchandise is equal in value to the money made selling it. Antonio holds a similar view, several lines later, when he tells Bassanio, “Thou knowest that all my fortunes are at sea, neither have I money…” Fortune (wealth) and money are two distinct and separate entities.

The parallel storyline in The Merchant of Venice involves a series of men vying to marry Portia. To win her as his wife, each man is given the opportunity to choose the correct box or casket out of three possibilities: one gold, one silver, one lead.

Out of eight suitors competing for Portia, the one portrayed as the most sincere is the Moor, the prince of Morocco. In fact, he’s the “fifth” after four Strangers. [In my previous research into “New Atlantis” and its metaphorical cipher regarding musical intervals, the 5th is extremely significant as I argue that both King Lear and The Tempest reference the usurpation by the tritone of the perfect 5th’s central position in the diatonic scale. For more information on that, see Chapter 14 of my book, The Next Octave.]

The Moor, however, has two strikes against him: Portia doesn’t like him (she’s in love with Bassanio) and he fails to pick the right casket. But although he doesn’t win Portia, he’s right not to choose the lead casket and he gives his reasoning: “[Men] that hazard all do it in hope of faire advantages.”

The Moor sees the lead casket as a bet, and he’s not given to gambling. The man who would win Portia must “hazard” his wealth, something very unwise. And we know it’s unwise because Bassanio, in needing money to look rich while wooing Portia—a financial deception—was the reason for Antonio’s loan from Shylock in the first place. Below, Bassanio whines about her many suitors, saying “Had I but the meanes to hold a rivall place.”

This play on the word “meanes,” as I also discuss in my book, refers back to the mean or mese of the scale, the perfect 5th—portrayed by the Moor. The money borrowed from Shylock allows Bassanio to displace the Moor and win Portia’s hand. But to do so, Bassanio not only risks and misrepresents his own financial position, he also causes Antonio to literally “hazard all he hath.”

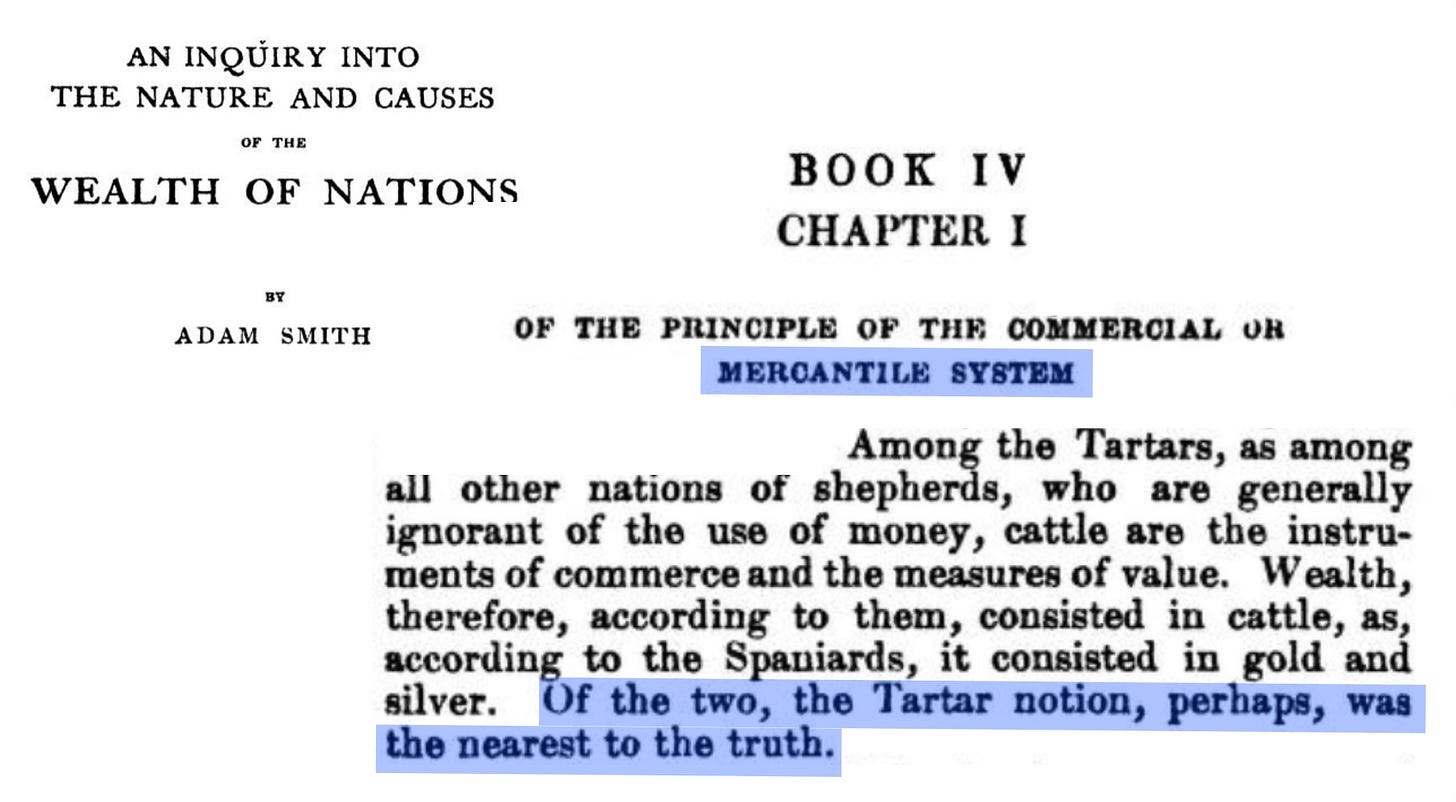

The fact that it’s a Moor who chooses wisely (although incorrectly) is a plot detail that only someone economically informed would write into this play. As I said earlier, Bacon’s anti-mercantilist view was an unpopular one. Almost every country in the 16th century was operating under the mercantilist belief that gold money was preferable to commodities—it was popular, and as most popular beliefs tend to be, it was economically wrong. But there was a society that held this unpopular view, and that society was the Tartarians, a group often associated with the Lemurian Moors. A hundred and fifty years after Shakespeare, Adam Smith wrote this about Tartarian economics:

The fact that Tartars operated in opposition to mercantilist views could go far in explaining why they were so reviled, maligned, and eventually attacked and annihilated. Tartarian society, basing their economy on cattle, was basing their economy on capital. As I mentioned in another video, the term capital evolved from the word kaput, meaning head, and capital referred to how many head of cattle, unconsumed, that a farmer owned. Because they were on the hoof and uneaten, this cattle, this capital represented wealth and the ability to produce value into the future.

Once again, we see “Shakespeare” as prescient and incredibly well informed, this time in the field of international economics. And for Bacon’s unusual take on money to show up in The Merchant of Venice strongly suggests a Baconian authorship of the works of Shakespeare. But the smoking gun is the shared image, in both The Merchant of Venice and Book 8 of the Advancement of Learning: the comparison of money and flesh. Shylock equates the two, substituting the debt of money with a pound of flesh. Bacon disagrees, having the last word: “it is not Monies that is the sinews of Fortune.”

![Stephanie McPeak Petersen [] writer in resonance](https://substackcdn.com/image/fetch/$s_!jz_a!,w_80,h_80,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F63c3ebac-43b9-478a-9aed-12c7f5458a70_600x600.jpeg)

![Stephanie McPeak Petersen [] writer in resonance](https://substackcdn.com/image/fetch/$s_!jz_a!,w_36,h_36,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F63c3ebac-43b9-478a-9aed-12c7f5458a70_600x600.jpeg)